Rushing to the Top [Pitch]

Undervalued ~$2B SaaS business with healthy growth, strong NRR, high gross margins, and long-term compounder potential.

Overview

Summary: Our first post on “Hidden Gems” provides a brief overview of Semrush, a small cap B2B SaaS marketing platform with healthy growth and strong margins that is exhibiting early signs of “compounder” qualities. Despite the stock climbing 78% over the past year, its NTM revenue multiple remains well below the industry median on a growth adjusted basis.

What is Semrush?

Comprehensive SaaS platform that enables customers to grow online visibility across all marketing strategies.

Offers 55+ products encompassing search engine optimization (SEO), pay-per-click (PPC), content marketing, social media management, and competitive research.

Why is Semrush interesting today?

Raised FY24 guidance and management is focused on sustained growth, expanding profitability, and generating greater FCF.

Growing revenue ~20% Y/Y, despite a very tight B2B spending environment.

Sustainable growth and profitability is top priority for management and the team has backed this commitment with long-term targets (below).

Large customers are growing quickly (32% Y/Y), lifting avg. revenue per user (ARPU).

Launching and monetizing AI powered products and features for greater efficiency, ease of use, idea generation, etc.

AI products aid in new customer acquisition and retention. Concentrating those offerings in higher pricing tiers drives customer upsells.

Strong competitive moat. Semrush is the only comprehensive marketing/online visibility provider in a fragmented digital marketing tools space, enabling upselling and cross selling opportunities not embedded in competitor businesses.

Key Financial Stats

1Q24 Earnings

ARR of $354.2M, +21% Y/Y

Revenue of $85.8M, +21% Y/Y (1pp above midpoint of guide)

Non-GAAP operating margin 11.3% (3pp above guide)

FCF of $12.0M, FCF margin of 14.0%

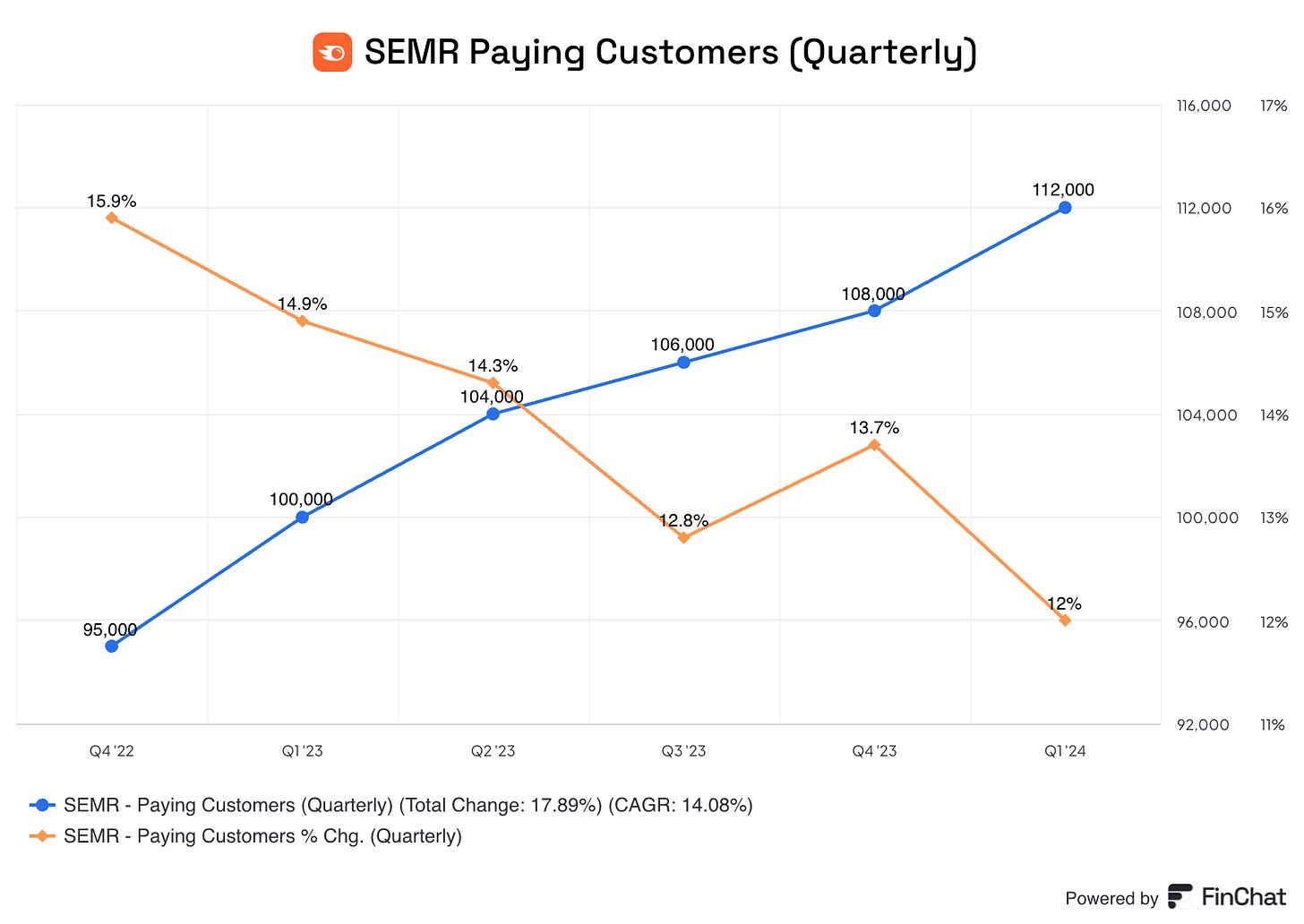

Nearly 112K paying customers, +10% Y/Y

NRR of 107%

FY24 Guidance

Revenue of $366-$369M, +19-20% Y/Y (slightly higher than prior guide)

Non-GAAP operating margin of 10.5-11.5% (previously 10-11%)

FCF margin of 8% (previously 7-8%)

Long-Term Margin Targets

Gross Margins of 80% (similar to today)

Operating Margins of 20% (nearly double 1Q24 margins)

Industry Comp Valuation - Quick & Dirty

Semrush

EV/NTM Revenue 4.96x

Growth Adjusted EV/NTM Revenue: 0.26x (assuming 19% NTM growth)

Software Industry (per Clouded Judgement):

Industry Median EV/NTM Rev 5.2x at a median growth rate of 12% NTM

Industry Median growth adjusted EV/NTM Rev 0.4x

“Mid Growth” Median EV/NTM Rev 7.8x at a median growth rate of 15-27% NTM (~21% NTM as midpoint)

Implied Upside:

To Industry Median EV/NTM Rev: +4%

To Industry Median growth adjusted EV/NTM Rev: +53%

To “Mid Growth” Median EV/NTM Rev +57%

Financial Visualizations

ARR growth continues to show signs of stabilization as softness in paying customer growth is offset by strength in ARPU growth.

Paying Customers growth has moderated in recent quarters, but continues at a healthy pace.

ARPU growth has re-accelerated in recent quarters, reflecting cross-selling and up-selling successes.

Net Revenue Retention appears to be bottoming and re-accelerating after a period of contraction.

Revenue continues to grow in the low-20s% range after bottoming in 2Q23.

Gross Margins remain very high and above long-term management targets of 80%.

EBITDA Margins have expanded reflecting stronger gross margins and greater cost discipline.

Net Margins remained positive for 3 consecutive quarters, aligning with management’s commitment to sustainable growth and profitability.

FCF Margins reach a new high in 1Q24, indicating management’s greater capital discipline and cash flow optimization.

Sources used in this post include FinChat.io and company filings.

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but no liability is accepted for any inaccuracies. This post and newsletter are for informational purposes only and are not an investment recommendation.

This post, newsletter, and the information presented are intended for informational purposes only. The views expressed are the author’s alone and do not constitute an offer to purchase, sell, nor are they a solicitation of an offer to buy, any security. Additionally, the views herein are not a recommendation for any investment product or service.