Fresh Tech, New Management [Pitch]

$4B software business trading at a steep discount to fair value following management transition, despite a history of strong execution.

Thesis

The market has punished FRSH since its founder and CEO stepped down to focus on product development (shares down ~30% since) and appears to be ignoring the new CEO’s experience and history of strong execution in various leadership roles.

The stock currently trades ~40% below the industry median EV/NTM revenue multiple and ~90% below the industry multiple on a growth adjusted basis.

The company has consistently beat analyst expectations on the top and bottom line in recent years, and could progressively re-rate as this trend continues and confidence in the new CEO grows.

Newer AI products/features may be a future growth benefit, but adoption is still in the early phases.

Overview

Company: Freshworks - FRSH 0.00%↑

Industry: Customer & Employee Engagement Software

Founded: 2010

Headquarters: San Mateo, CA

Founders: Girish Mathrubootham and Shan Krishnasamy

Current CEO: Dennis Woodside (Beginning 5/1/24)

What is Freshworks?

A B2B software business that builds and delivers customer service, IT service management, and sales & marketing software for businesses of all sizes.

Founded in India in 2010, initially selling customer service solutions to small/medium businesses (SMBs).

Later expanded its offerings to IT service management (2014), sales (2016), and marketing (2018).

Customer base has progressively shifted towards mid and large enterprises over time, and the business is directly competing with large incumbents.

Product Overview:

Freshservice - IT Service Management: Represents ~50% of revenue today and is growing at a mid-30% Y/Y rate.

Software for handling IT issues, asset management, and change management.

Competitors: ServiceNow, Atlassian Jira, BMC Remedy

Freshdesk & Freshchat - Customer Support: Combined represent <50% of revenue today and is growing below 10% Y/Y.

Freshdesk: Software that provides a multi-channel ticking system, automation, and self-service.

Freshchat: Messaging software offering live chat, chatbots, and multichannel messaging support.

Competitors: Zendesk, ServiceNow, Salesforce Service Cloud, LiveChat

Freshsales & Freshmarketer - Sales & Marketing: Combined represents a small percentage of revenue.

Freshsales: Customer relationship management software that manages leads, contacts and sales pipelines

Freshmarketer: Marketing automation software for email campaigns, lead scoring, and customer journeys.

Competitors: Hubspot Marketing Hub, Marketo, Mailchimp

Why is Freshworks interesting today?

The stock is down ~30% since founder and CEO Girish Mathrubootham stepped down to focus on product development, which may present an opportunity as CEO Dennis Woodside’s leadership and execution history appear under-appreciated:

President of Impossible Foods, overseeing all aspects of the business over a 3 year period where the company’s revenue grew 10x.

COO of Dropbox for 4.5 years, scaling the business from $300M to $1.4B, instrumental in taking the company public.

Held various sales positions at Google over 9 years, at one point overseeing an $18B advertising sales business.

Served as CEO of Motorola Mobility after the company was acquired by Google.

On the board of ServiceNow from 2018-2022, Freshworks’ current competitor in the IT solutions segment.

FRSH’s software portfolio has strong product reviews and is winning more mid/large enterprise deals, despite competing with ServiceNow, Zendesk, Hubspot, Salesforce and others.

Management is focused on ease of use, affordability, and customer satisfaction, which is ideal in a tight software spending environment.

The company consistently performs above analyst expectations and the stock may re-rate as this trend continues and investor confidence improves following the management transition.

Stock currently trades ~40% below the industry median EV/NTM revenue multiple and ~90% below the industry multiple on a growth adjusted basis, but has a better growth and margin profile.

Newer AI products/features may add to the future upside case, particularly as adoption of AI customer service solutions ramps up.

Key Financial Stats

1Q24 Earnings

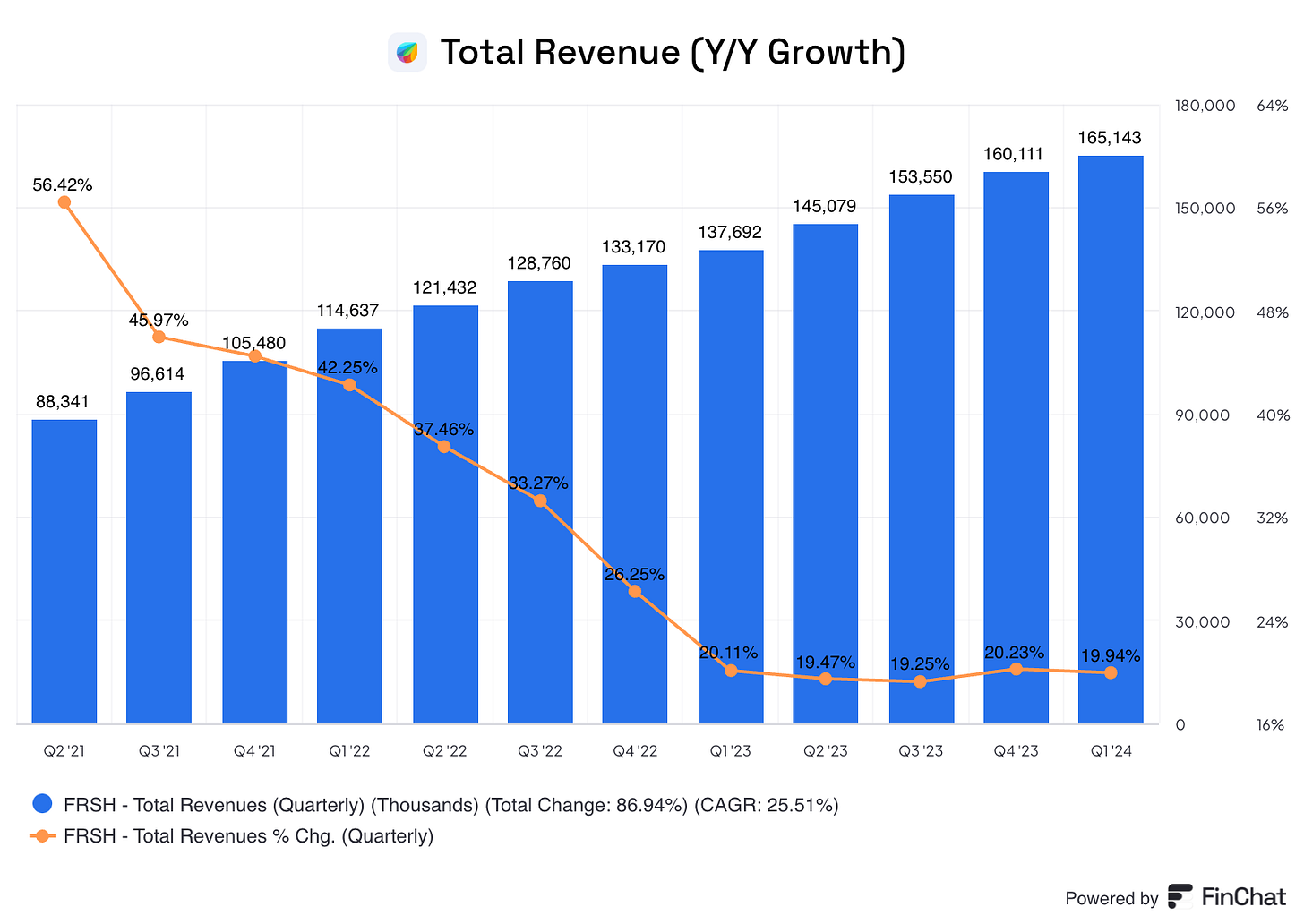

Revenue $165M, +20% Y/Y

Total Customers 67.5K, +4% Y/Y

Customers >$5K ARR, +11% Y/Y

Customers >$50K ARR, +29% Y/Y

Net Dollar Retention 106% - defined as ending ARR (annual recurring revenue) of a customer cohort from 12 months prior divided by beginning ARR from 12 months ago.

Non-GAAP Income from Operations of $21.8M

Non-GAAP Net Income per Share of $0.10

Free Cash Flow of $38.7M

FRSH 2Q24 earnings scheduled for 7/30/24

2Q24 Guidance

Revenue $168-$170M, +16-17% Y/Y

Non-GAAP Income from Operations of $6.5-$8.5M

Non-GAAP Net Income per Share of $0.05-$0.06

FY24 Guidance

Revenue of $695-$705M, +17-18% Y/Y

Non-GAAP Income from Operations of $58-$64M

Non-GAAP Net Income per Share of $0.32-$0.35

2026 Long Term Guidance

Revenue of $1B, 20-22% CAGR (compound annual growth rate)

Gross Margin 83%

Operating Margin 18-20%

FCF Margin 20-22%

Dilution below 3% annually

Valuation

Industry Comp (Software industry multiples from Clouded Judgement)

FRSH trades at a steep discount to the median software peer, despite stronger NTM growth expectations, higher gross margins, and higher FCF margins than the industry median.

FRSH EV/NTM Revenue 3.7x

40% below the industry median of 5.2x

FRSH Growth Adjusted EV/NTM Revenue: 0.21x (assuming 17% NTM growth)

90% below the the industry median of 0.4x

Quick Discounted Cash Flow (DCF)

DCF model implies FRSH trades ~40% below fair value today with conservative estimates below sell-side expectations. FRSH has consistently beat top and bottom line expectations historically.

My assumptions:

Revenue growth improves to 20% Y/Y by 2026, and growth slows 1pp per year through 2033, terminal growth rate of 8% for 10 years. This is more conservative than sell-side assumptions through 2026.

Levered FCF margin improves steadily up to 21% in 2026 with 25bps of margin expansion per year through 2033. This is more conservative than sell-side assumptions through 2026.

Dilution of 3% per year. This is higher than management guidance of dilution below 3% per year.

Financial Visualizations

Total Revenue

Revenue by Region

Paying Customers by Revenue Tier

Net Dollar Retention Rate (NDRR)

Gross Margin

Free Cash Flow Margin

EBITDA Margin

Net Profit Margin

Enterprise Value / Next 12 Months Revenue

Enterprise Value / Next 12 Months Revenue

Sources used in this post include FinChat.io and company filings.

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but no liability is accepted for any inaccuracies. This post and newsletter are for informational purposes only and are not an investment recommendation.

This post, newsletter, and the information presented are intended for informational purposes only. The views expressed are the author’s alone and do not constitute an offer to purchase, sell, nor are they a solicitation of an offer to buy, any security. Additionally, the views herein are not a recommendation for any investment product or service.

Great post. I love the details here. I have a different view on it's challenges which I've outlined in the link below. Would love your thoughts. https://open.substack.com/pub/stratfinology/p/why-is-freshworks-trading-at-a-discount