Staying on Frequency [Pitch]

A specialized electronic components business serving multiple high-growth end markets, trading at an attractive price.

Summary

M-Tron Industries (MPTI) is a specialized, vertically integrated leader in the frequency control market, positioned to capitalize on the sustained growth of the defense, aerospace, and telecom markets.

MPTI’s competitive advantage is rooted in its rapid product innovation, full control of its manufacturing processes, and deep customer integration. I believe this edge positions MPTI to outperform the market’s FCF growth expectations over the next decade. Additionally, while not part of my base case, opportunistic M&A could further improve MPTI’s market position and enhance shareholder returns over time.

Company Overview

Founded in 1965 and headquartered in Orlando, Florida, M-Tron Industries designs, manufactures, and markets a wide range of frequency and spectrum control products. These include filters, oscillators, and resonators + solutions, which are critical components in high-performance electronic systems. Its products are known for their reliability and precision, making them ideal for use in demanding environments such as commercial aerospace, space & satellite communication, electronic warfare, guided munitions, and radar.

Let’s quickly review these products and their applications, as described by MPTI:

Filters: “limit the bandwidth of signals, allowing only a certain range of frequencies to pass through. This is important in data communication, radars, and electronic warfare where bandwidth constraints need to be enforced to prevent signal distortion or overcrowding of the channel.”

Oscillators: “signal at precise frequencies, which are necessary for RF communication, radars, and electronic warfare systems. Controlling the frequency of the oscillator over time and temperature with minimal phase noise ensures reliable transmission and reception of signals.”

Resonators + Solutions: “solutions come in various forms such as Integrated Microwave Assembly, Multi-Function Module, where MPTI acts as an extension of the customer’s engineering team. Common solution applications include radar systems, electronic warfare systems, communication systems, microwave instrumentation, and aerospace and defense applications.”

For some additional background, MPTI exists as a vertically integrated pure play created through M-Tron’s acquisition of PTI in 2004 (when M-Tron was part of LGL Group). This acquisition created a ‘one stop shop’ experience for customers while maximizing the combined engineering and manufacturing resources of the two companies. MtronPTI was eventually spun off from LGL Group in 2022, enabling shareholders to evaluate the performance and future potential of the standalone entity.

Competitive Advantage

M-Tron's competitive advantage lies in its specialization, technological expertise, and ability to launch new products rapidly.

The company focuses on customized products and uses the same modeling tools as its customers for solutions applications, allowing for effortless integration and design collaboration with its customer base. Further, the business has implemented rapid in-house prototyping methods to speed development times and offers custom solutions to reduce test and integration times.

This approach has to enabled MPTI to build “sticky” relationships with some the largest and most entrenched aerospace & defense, avionics, and industrial businesses in the world and gain share these markets over time.

Naturally, new product development is a key driver of growth for the business, which releases more than 200 new products each year and has a portfolio exceeding 900 products today. ~30% of revenue over the past 4 years has come from new products introduced since 2020. The company's commitment to rapid launches, and attention to customer needs, positions it well to capitalize on the increasing demand across its end markets. Further, the combination of its rapid launch strategy and ability to build long-term collaborative relationships in its end markets suggests MPTI has a strong moat that it aims to expand further in the future.

End Markets

MPTI benefits from secular tailwinds due to its expanding end markets, which tend to have long growth cycles. Fortunately for MPTI, it already has relationships some of the largest players, which reduces the need for aggressive S&M to penetrate these markets. Consistent end market growth and the “sticky” nature of MPTI’s existing customer relationships significantly de-risks the revenue trajectory of the business in my opinion.

Now, let’s review the company’s primary end markets in a bit more detail:

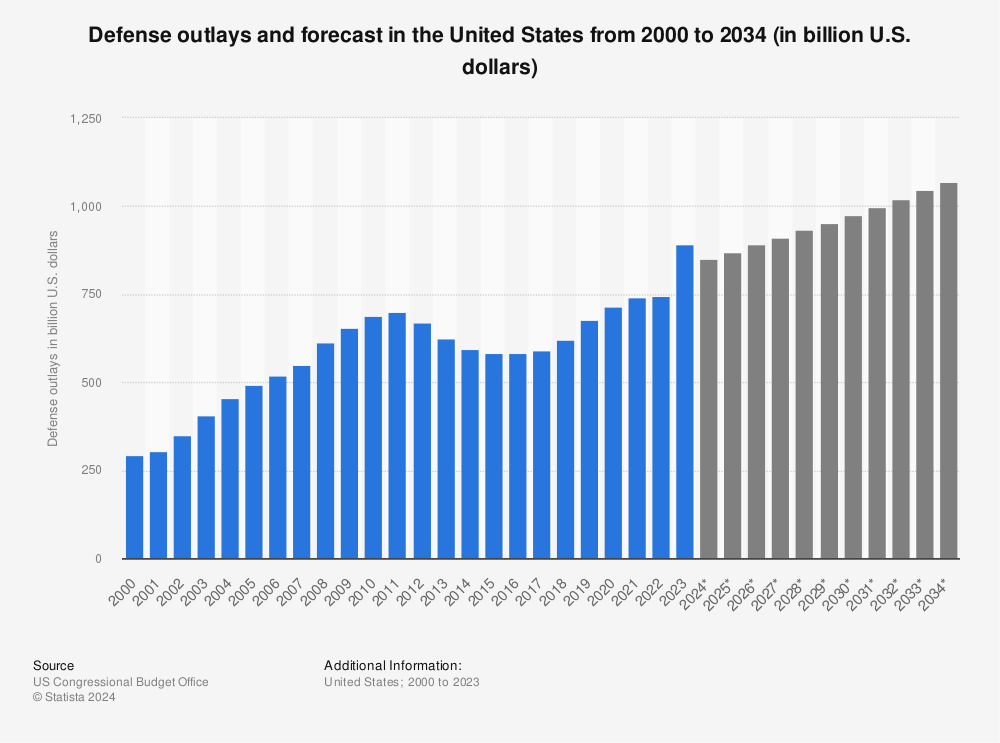

Defense Electronics - Est. ~6% CAGR: Today’s global threat environment remains elevated, driving the need for greater defense spending in most years. While budget forecasts are typically fairly linear, further escalations in Eastern Europe (Ukraine), the Middle East (Israel), or APAC (Taiwan) could lead spending to surpass expectations in the coming years. MPTI is likely to benefit most from modernization spending, whether in avionics, guided munitions, or communication infrastructure.

As an example, many countries are developing more sophisticated guided and hypersonic missile systems to penetrate existing missile defense systems (think Israel’s “Iron Dome”). As a result, the need for advancement in missile defense systems, which also rely on guidance systems, is ever increasing. MPTI is positioned to benefit from this guided munitions “arms race”. According to Grandview Research, this sub-market is projected to grow at a ~5.5% CAGR and key players include the “Big 4” defense contractors (General Dynamics, Lockheed Martin, Raytheon, and Northrop Grumman), which are all MPTI customers.

Commercial Aviation - Est. 7% CAGR: According to the Centre for Aviation Fleet Database, commercial aircraft deliveries continue to rise, but remain below pre-Covid levels. The global order backlog for Boeing and Airbus (both MPTI customers) reached a record high in 2023 and equates to ~13 years of production, indicating future aircraft production and the need for MPTI’s harsh environment oscillators and leading-edge resonators will persist for more than a decade.

Satellite Communications (SATCOM) - Est. ~10% CAGR: Space has been a hot topic of late with the rise of the private space flight industry and numerous launches over the years from the likes of SpaceX, Blue Origin, Rocket Lab, etc. The SATCOM market specifically, or the industry and infrastructure that provide communication services via satellites, is expected to grow at a double digit pace for the foreseeable future (per Grandview Research and others). This growth is expected to be driven by satellite equipment and ground infrastructure (antennas, stations, control centers), as well as the communication services (TV, internet, phone, data comms) that utilize the equipment.

MPTI has over 125 design wins across satellite platforms and manned spacecraft with expertise supporting low earth orbit, medium earth orbit, and geostationary earth orbit applications, which enables it to participate in the SATCOM industry’s growth. MPTI aims to fill the need for high power space-level transmitters, RF components, and sub-assemblies to enable mission success.

Key Financial Stats

Strong top-line growth: Revenue has been growing above 10% for the past 3 years and is likely to continue at a 7-9% CAGR for the foreseeable future, driven largely by end market growth. I anticipate revenue growth to be somewhat “chunky” due to the timing of large program related orders/shipments, but could outpace end market industry growth if share gains occur.

No debt: Strong balance sheet with $7M in cash and equivalents and no debt. It is great to see a business expand over multiple decades and have a clean balance sheet after acquisitions and expansions.

Growing cash balance and strong FCF margins: MPTI’s cash balance is growing because the business consistently produces cash (11% FCF margins). Growth of the business is self-funded and MPTI intends to use its growing cash balance to acquire undervalued businesses.

Margin expansion: Earnings are expected to grow much faster than revenue in the future due to margin expansion, though the path will likely be choppy since product mix can influence gross margins.

Increasing returns on capital: ROIC and ROCE are very high and have continued to increase over time (now in the high 30s % range).

Financial Performance

2Q24 Earnings Review

Revenue grew 16.4% Y/Y to $11.8M and Net income grew 36.6% Y/Y to $1.7M driven by strong defense program shipments.

Gross margins improved to 46.6% in 2Q24, primarily driven by improved production efficiencies due to previous investments and improved product mix to higher margin products.

2024 Outlook Raised: “With the continued momentum in defense-related sales, and the acceleration in production and shipments during the first half of 2024, MPTI management has raised the outlook for fiscal year 2024, increasing revenues to a range of $46.0 million to $48.0 million from a previous range of $43.0 million to $45.0 million. MPTI has good visibility for the remaining two quarters of 2024 and expects EBITDA to continue to be in the 19% to 21% range.”

Progress on Strategic Direction:

Management remains satisfied with top-line growth and margin expansion and its commitment to achieving May 2024 Investor Day targets remains strong. Progress on new products, pricing, and efficiencies are clear.

MPTI has increased its potential acquisition pool to include companies inside and outside its current space. Management is specifically looking for undervalued companies where rapid top and bottom line growth can be achieved.

Management remains exciting about growth in the Space & Satellite, Radar, and Electronic Warfare verticals.

Valuation

I believe this business is at worst fairly valued and is likely trading ~20% below fair value, though the true long-term margin potential of the current business is unclear and could be much greater than expected if a series of margin accretive acquisitions occur over the next decade.

The market appears to be pricing in roughly 10 year FCF per share CAGR of ~14%, with a 10 year terminal FCF growth rate of ~3%, assuming a 10% discount rate. This appears achievable, as revenue can likely sustain a 7-9% CAGR for at least 10 years and FCF is likely to grow faster as margins improve and the business realizes further operational efficiencies. Risk to the top-line here is quite low in my opinion, given MPTI has built strong relationships with large entrenched players in its end markets (though this can be a double edged sword).

Assuming a 16% FCF CAGR over 10 years, which is just ~2pp higher than current market expectations, would imply this business is trading 20% below fair value. This growth could come from a combination of faster than expected top-line growth or greater than expected cost savings - upside cases can be made on both fronts. Thus far MPTI has exceeded its own externally communicated growth expectations and has outlined its plans to sustain revenue growth above the pace of its end markets, while improving its margin profile further.

I believe even higher revenue and FCF CAGRs are achievable if MPTI makes a few margin accretive horizontal acquisitions and can realize savings on the production side through synergies or outsourcing. While I believe the management team has more than enough M&A experience and financial prowess to achieve this, I don’t think it is appropriate to assume this is a realistic outcome until there is supporting evidence.

Risks

Revenue and Margin Volatility: MPTI relies on a limited number of large customers to drive growth. Changes in customer relationships could cause significant revenue fluctuations. Margins may face pressure from product mix shift, increasing costs, price competition, or inefficiencies.

Cyclical Demand: MPTI’s end markets may face fluctuations in demand based on economic conditions, government budgets, and geopolitical factors.

Technological Obsolescence: MPTI faces the risk that its products could become obsolete if competitors develop superior technology or if there are significant advancements in the industry.

Competition: MPTI might compete with larger, more established firms with greater resources. The company could face pricing pressure, loss of market share, or reduced profitability if unable to compete effectively.

Production and Quality Control: Issues with manufacturing processes, including quality control failures, could lead to costly recalls, warranty claims, or damage to the company’s reputation.

Key Personnel: The company’s success heavily depends on the expertise of its scientists and engineers. Losing key individuals could negatively impact the MPTI’s ability to innovate, launch new products, or meet the needs of its customers.

Geopolitical Risks: If MPTI operates or has significant business in regions with political instability, it could face disruptions or sanctions.

M&A: If MPTI is involved in M&A activity, there are risks related to integration, potential overpayment, and cultural clashes that could affect the success of the acquisition.

Conclusion

To recap, MPTI is specialized and vertically integrated, serving critical end markets expected to grow the top-line 7-9% over the long term. Their ability to quickly launch new products and maintain strong relationships with major industry players, provides it with a competitive edge and a strong growth trajectory.

While the company faces risks due to its size and concentrated customer base, I believe its strategic focus on innovation, customer collaboration, cost efficiency, and targeted acquisitions could drive revenue and FCF growth above market expectations over the coming decade, enabling investors to acquire shares at a reasonable price today.

Sources used in this post include FinChat.io, company filings, Statista, Centre for Aviation Fleet Database, and Grand View Research.

The information presented in this newsletter is the opinion of the author and does not reflect the view of any other person or entity. The information provided is believed to be from reliable sources, but no liability is accepted for any inaccuracies. This post and newsletter are for informational purposes only and are not an investment recommendation.

This post, newsletter, and the information presented are intended for informational purposes only. The views expressed are the author’s alone and do not constitute an offer to purchase, sell, nor are they a solicitation of an offer to buy, any security. Additionally, the views herein are not a recommendation for any investment product or service.

in your opinion! (no editing allowed it seems)

new to this stock, what is your opinion has been the catalyst since your post? or was it this post? 😃